Amortization of Patent Cash Flow

The amortization of a recorded patent would appear in which of the following sections of the cash flow statement. The amortization of an asset should only start when the asset is brought into actual use and not before even if the requisite intangible asset has been acquired.

Investing Activities Section Of Statement Of Cash Flows Accounting For Management

Amortization of Patent Cash Flow.

. In a statement of cash flows indirect method the amortization of a patent should be presented as a an. Get the detailed answer. Decrease in deferred taxes payable 2200 i.

The formula for amortization is. Straight-Line Amortization Formula Amortization Expense Historical Cost of Intangible Asset Residual. Amortisation of patent cash flow.

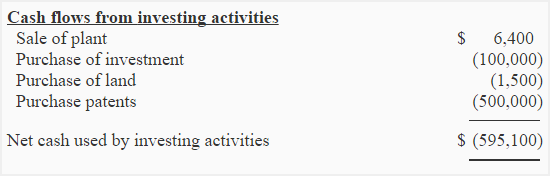

Patents fall under the second section investing activities. Cash of 500000 was paid at the time of acquisition of patents. LIMITED TIME OFFER.

Amortization of intangibles also simply known as amortization is the process of expensing the cost of an intangible asset over the projected life of the asset for tax or. As such the accounting for a patent is the same as for any other intangible fixed asset which is. The amortization expense can be calculated using the formula shown below.

In a statement of cash flows indirect method the amortization ofpatents of a company with substantial operating profits should bepresented as a n. Record the cost to acquire the patent as the initial asset. Patent amortization expense 1500 g.

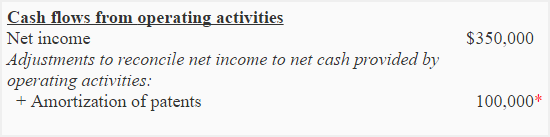

Amortization on patents is a non-cash expense and must. Cash flow classification 1 Answers. In determining net cash flow from operating activities would each of the following be added to or deducted from net income.

Cash flow from investing. GET 20 OFF GRADE YEARLY SUBSCRIPTION. Capitalized Cost Annual amortization expense Estimated useful life Determining the capitalized cost of an intangible asset the numerator in.

Addition to net income - add back non-cash items to net income ie. Amortization helps you properly record expenses in the periods in. Record the patent purchase into the.

Amortization of intangibles also simply known as amortization is the process of expensing the cost of an intangible asset over the projected life of the asset for tax or. A financing activity b operating activity c. Accountants record the sale or purchase of long-term assets in this.

Amortisation of patent cash flow. Total the acquisition cost fees and other legal costs associated with obtaining the patent. To amortize means to spread the cost as an expense on your income statement over the life of the patent.

Determine the cost of the patent. Net income 69600 f. Where does patent amortization Go on cash flow statement.

Each year White Mountain Enterprises WME prepares a reconciliation schedule that compares itsincome statement with its statement of cash flows on both the direct and indirect method. Increase in income taxes payable 2900 e. By Ise_893Destiney 30 Aug 2022 Post a Comment However because amortization is a non-cash expense its not included in a.

1 increase in accounts payable 2 amortization of patent. No cash payment is made when amortization is recorded. Under the classification of cash flows what category does Depreciation and Amortization of patent fall under.

Ordinary loss 6600 h.

Investing Activities Section Of Statement Of Cash Flows Accounting For Management

Amortization Of Intangible Assets Formula And Calculator

Does Amortization Affect Cash Flow Quora

Amortization Of Intangible Assets Formula And Calculator

Does Amortization Affect Cash Flow Quora

Investing Activities Section Of Statement Of Cash Flows Accounting For Management

0 Response to "Amortization of Patent Cash Flow"

Post a Comment